Medicare and type 1 diabetes

Medicare is a federally run health insurance program for people age 65 and older and people with disabilities.

This guide will provide some general detail about options for Medicare coverage and identify specific issues that are very important for people with type 1 diabetes (T1D) to understand as you make decisions about your Medicare coverage.

The best places to find information on the Medicare program are www.medicare.gov, the Medicare and You Handbook and the Medicare Plan Finder.

The basics of the Medicare benefit

Medicare consists of four basic parts, including:

- Part A, which covers primarily inpatient hospital and skilled nursing facility services.

- Part B, which covers primarily physician and outpatient hospital services, as well as durable medical equipment such as insulin pumps, test strips and some CGMs.

- Part C, also known as Medicare Advantage (MA) plans, are offered by private insurance companies and cover the same benefits as Medicare Part A and B, plus many offer drug coverage, similar to Part D

- Part D, which covers prescription drugs that you typically obtain at a pharmacy, and may also cover disposable insulin “patch pumps”.

As a person with T1D, Parts B and D will be the most relevant to your day-to-day diabetes management. We’ll discuss why below.

Options for coverage under Medicare

When you are eligible to enroll in Medicare, you have two basic options.

The first option is to enroll in Original Medicare Parts A and B, which is managed by the federal government. You’ll need to enroll in a Part D drug plan separately from your enrollment in Original Medicare since the Part D portion of the benefit is offered only through commercial insurers.

Depending on your income, your costs for Part D coverage may be significantly reduced. In order to receive this reduction, you have to apply for the “extra help.” There’s no downside for applying and you can re-apply every year since your income and the qualifying criteria change each year.

If you enroll in Original Medicare, you can also purchase a separate Medicare supplement or Medigap policy that can cover your deductibles and cost-sharing under Parts A and B (but not Part D) in return for a fixed monthly premium. As explained below, the ability to purchase a Medigap policy could be critical for many people with T1D and the timing of when you purchase Medigap coverage is very important.

You can purchase a Medigap policy any time after you enroll in Medicare. However, with a few exceptions, if you purchase it after the six-month period that begins when you initially enroll in Part B, Medigap insurers are permitted to deny you coverage or charge you a higher premium based on any pre-existing health condition you may have (such as T1D). Some states, including Massachusetts, Minnesota and Wisconsin, have different rules for Medigap plans so be sure to find plan information specific to your state. There are also different rules for people under age 65 who are eligible for Medicare due to disability (such as blindness) or End-Stage Renal Disease (ESRD). For more information on choosing a Medigap policy, click here.

The second option is to enroll in a Medicare Advantage (MA) plan, which is coverage that is at least equivalent to Original Medicare, offered through a commercial insurer. Most MA plans also cover the Part D portion of the Medicare benefit, though some don’t. If you select an MA plan that does not cover Part D prescription drugs, you’ll need to sign up for a Part D plan separately. Medigap plans do not work with MA or Part D plans.

As you make decisions about which route to take, you should carefully review information in the Medicare & You Handbook, notably deadlines for enrolling and particulars around coordinating other types of coverage such as those available to retirees from a former employer or from the military or U.S. Department of Veterans Affairs. You should also pay special attention to rules around income changes that may affect how much you will pay for Medicare part B.

The authoritative place for evaluating available options for Medicare coverage is the Medicare Plan Finder.

How Medicare beneficiaries with T1D can best manage diabetes health care costs

It is impossible to provide a single answer to the question “What is the best decision for people with T1D who are covered under Medicare?” The response depends on a number of factors, including whether you have complications associated with T1D or other health conditions that need treatment, your financial situation, whether you prefer to have higher fixed monthly premiums in return for lower cost sharing, and how much you care about having broad access to physicians and hospitals.

Some key questions to ask yourself are:

- Are my diabetes devices covered by Medicare, and if so, are they covered under Part B or Part D? What are the costs associated with coverage under different parts?

- Am I willing to change insulin delivery method for the sake of cost savings?

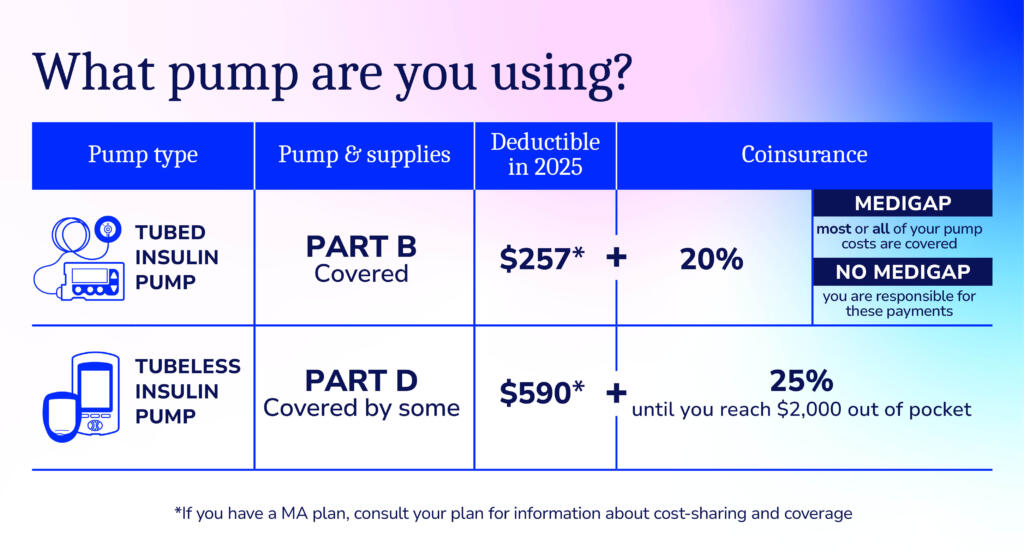

Keep in mind that insulin is covered by Part B or Part D, depending on how it is administered. If you are using a tubed pump, the insulin is covered by Part B. This is because drugs delivered by a long lasting device are part of the “durable medical equipment” benefit. If you are using a disposable patch pump or are using multiple daily injections, insulin will be covered by Part D plans.

Many insulins covered by Part D plans or Part B plans have an out-of-pocket cost of no more than $35. Medicare Advantage (MA) and Part D plans can still limit coverage to certain brands of insulin, however they must cover at least one of all types of insulin (long-acting, rapid-acting, etc) and in the different delivery forms (vials, pens, inhaled, etc). The Medicare drug finder can help you find a plan that works for you.

Deductibles won’t apply for covered insulins for both Part B and D. This means that you will only pay the copay for your insulin, and the amount paid will count toward your deductible. Keep in mind that your CGM, test strips, insulin pump or supplies will still be subject to the deductible, which is to be determined for for Part B and a maximum of $590 for Part D plans.

In 2025, Part D cost-sharing is capped at $2,000 for the year. This cap does not apply to Part B drugs. There is also an option to spread costs throughout the year. This is an optional program and may be helpful if you are facing higher costs at the beginning of the year. This guide from Medicare can help you decide if this option will work for you. If you are interested in signing up for this option, you can contact your part D plan.

Insulin for use in a pump must be obtained from a Medicare durable medical equipment (DME) supplier, not a retail pharmacy. However, many national pharmacy chains are set up to bill Medicare as a DME supplier. Speak with your pharmacist to verify if they can do this. Typically the DME supplier is the same entity that provides your pump and associated supplies, however, not all DME suppliers are set up to provide insulin.

Test Strips

Test strips are covered by Medicare Part B. People who use insulin are covered for 100 test strips per month however, if you and your doctor can show that you need to test more often, Medicare may cover additional test strips. Medicare may require you to mail-order your test strips from contracted supplier. Your doctor will need to write you a prescription for test strips to ensure they are covered.

Coverage of CGMs under Medicare

Medicare will only cover a CGM if the FDA has approved the CGM for use in diabetes treatment decisions or if it is FDA approved and pairs with an insulin pump. Standalone CGMs have been granted coverage under Medicare: the Dexcom G6 and G7, the Abbott FreeStyle Libre, Libre 2, and Libre 3, and the Eversense Implantable CGM. The Medtronic Guardian Sensor 3 CGM, when used as part of an automated insulin delivery (AID) system, is also covered by Medicare.

Coverage of insulin pumps and artificial pancreas systems under Medicare

Medicare covers tubed insulin pumps under its “durable medical equipment” (DME) benefit. There are specific medical eligibility criteria that must be met in order for such coverage to be given.

Part D plans may choose to cover patch pumps, including AID systems that use a patch pump. Medicare beneficiaries wanting coverage for a patch pump should check with any Part D plan they are considering joining, before doing so, in order to verify that the plan covers patch pumps. The manufacturer of your pump can also help you navigate your benefits and make sure you have coverage.

Medicare covers FDA-approved AID systems, including those made by Medtronic and Tandem and the related supplies. These systems consist of a tubed insulin pump and a CGM covered by Medicare Part B. Medicare also covers the Omnipod 5, with the pods covered by some part D plans and with the Dexcom CGM covered by Part B.